In spite of the sturdy corrections in the closing 30 days, synthetic intelligence is restful one in every of basically the most disruptive narratives in crypto. Whereas some AI cash bear struggled, others are showing resilience, making them key property to survey in the second week of February 2025.

SwarmNode.ai (SNAI) has been one in every of the strongest performers, surging over 170% in per week, whereas Venice Token (VVV) is trying a recovery despite transparency concerns. Meanwhile, Virtuals Protocol (VIRTUAL) has dropped 44% in per week, reflecting the broader slowdown in crypto AI agents.

Swarmnode.ai (snai)

SNAI serves because the backbone of SwarmNode, a platform designed for deploying serverless AI agents in the cloud. Via the SwarmNode Python SDK, customers can seamlessly coordinate and automate interactions between these AI-driven agents, optimizing workflows and bettering effectivity.

SNAI is one in every of the few AI Cash showing sturdy beneficial properties this week. It has surged over 170% in the previous seven days and pushed its market cap to $51 million. Technical indicators imply that a golden deplorable would possibly maybe even soon invent on the charge chart, signaling a doable bullish continuation.

If this occurs, SNAI would possibly well climb in opposition to the $0.749 resistance diploma, with a successful breakout opening the door for a transfer to $0.0839. On the assorted hand, if momentum fades, key helps lie at $0.039 and $0.027, with a deeper correction in opposition to $0.010 probably if these phases fail to preserve.

Venice Token (VVV)

VVV is the core token of Venice AI, a ChatGPT quite a lot of designed to prioritize privateness and unrestricted conversations. Founded by Erik Voorhees, the founder of ShapeShift, Venice AI integrates decentralized principles to be obvious that user autonomy and freedom of interaction.

To delivery with attach dispensed through an airdrop to early adoptersVVV has since been launched on the Imperfect chainwhere it rapid changed into one in every of basically the most trending tokens on the network.

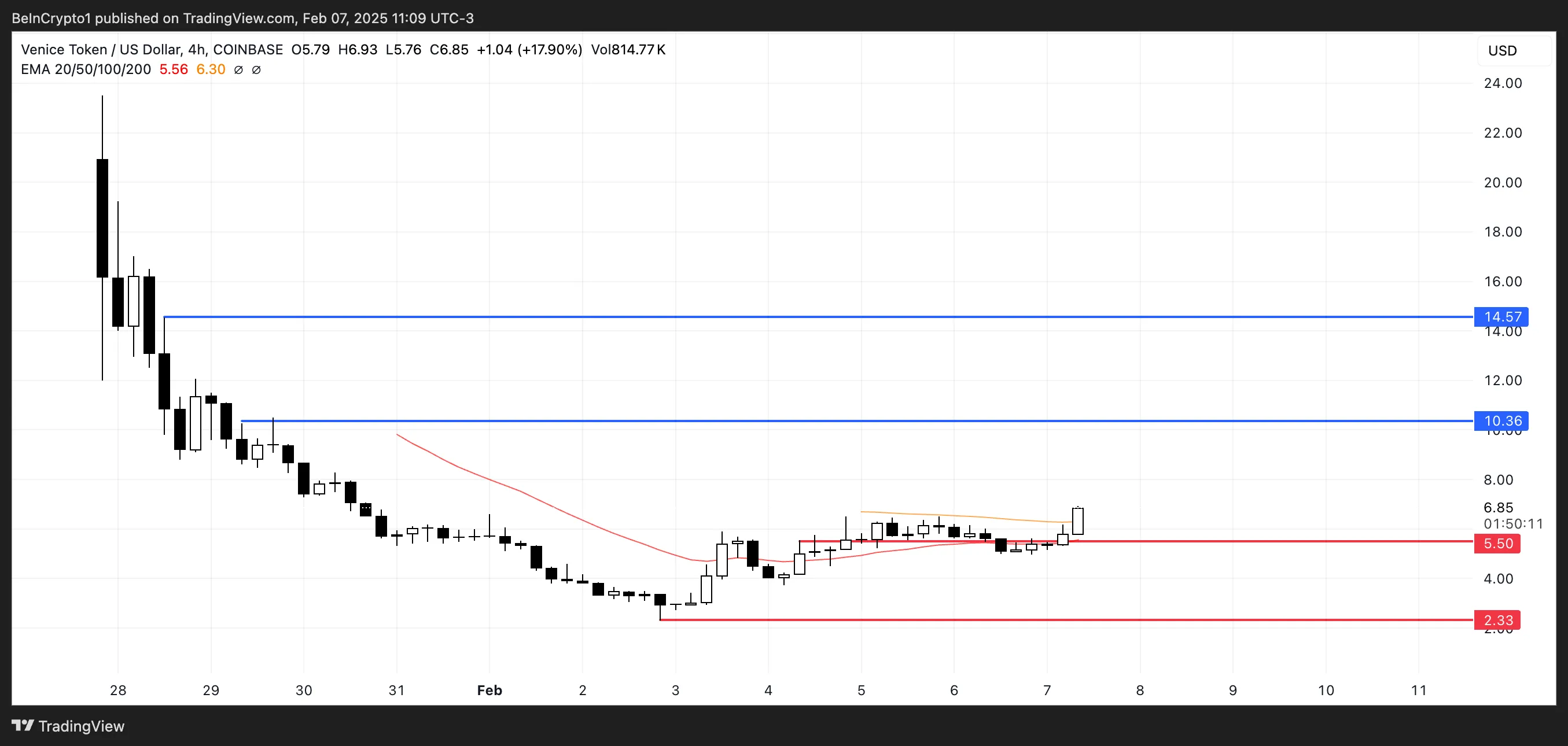

VVV is probably one of many few synthetic intelligence tokens posting beneficial properties this week, mountaineering roughly 8% over the previous seven days despite not too long previously hitting all-time lows.

If bullish momentum continues, VVV would possibly well soon say the $10.36 diploma, with a breakout presumably driving the charge in opposition to $14.57, its highest label since January 28.

On the assorted hand, concerns about transparency bear weighed on market sentiment. Some customers on X (previously Twitter) bear alleged that the mission’s team began selling VVV appropriate hours after its Coinbase listing.

If selling stress escalates, the token would possibly well retest give a take to at $5.50, with a deeper tumble to $2.33 probably if bearish momentum persists.

Protocol virtual (virtual)

VIRTUAL changed into once once the leading synthetic intelligence crypto, nonetheless it undoubtedly has confronted heavy losses. Its market cap has dropped 44% in the closing seven days to $813 million.

The token is struggling attributable to the broader correction in the AI sector and furthermore since the crypto AI agents market has considered declining engagement and stagnation in unusual mission launches.

On the assorted hand, if the hype surrounding crypto AI agents returns, VIRTUAL would possibly well earn momentum and take a look at resistance phases at $1.63 and $1.77, especially if its expansion to Solana brings more attention and unusual agents.

A breakout above these key phases, combined with renewed market excitement, would possibly well push VIRTUAL in opposition to $2.41, its highest trace in weeks.

On the diverse hand, if the correction deepens, the token risks falling additional, with arrangement back targets extending as low as $1.03.

Disclaimer

In accordance with the Have faith Mission pointers, this trace diagnosis article is for informational capabilities completely and can’t be regarded as monetary or investment advice. BeInCrypto is dedicated to appropriate, unbiased reporting, nonetheless market cases are subject to swap with out mediate. Repeatedly behavior your possess learn and consult with a official earlier than making any monetary decisions. Please show that our Phrases and Conditions, Privacy Coverageand Disclaimersbear been up thus some distance.