Synthetic intelligence (AI) tokens are making waves, with Humans.ai (HEART), VIRTUAL Protocol, and DIA emerging because the close gainers amongst AI coins within the third week of October. HEART has surged 88%, whereas VIRTUAL and DIA are up 76% and 21.67%, respectively.

Every mission offers uncommon contributions to AI and blockchain expertise, fueling investor curiosity. Nonetheless, chart indicators imply caution, with key resistance ranges and overbought conditions doubtlessly impacting future movements.

Humans AI (HEART)

Humans.ai (HEART) has surged 88% within the past week, positioning itself because the supreme gainer amongst AI-linked coins with a market cap of no longer lower than $100 million. The mission is building a comprehensive platform for gigantic-scale AI creation and governance.

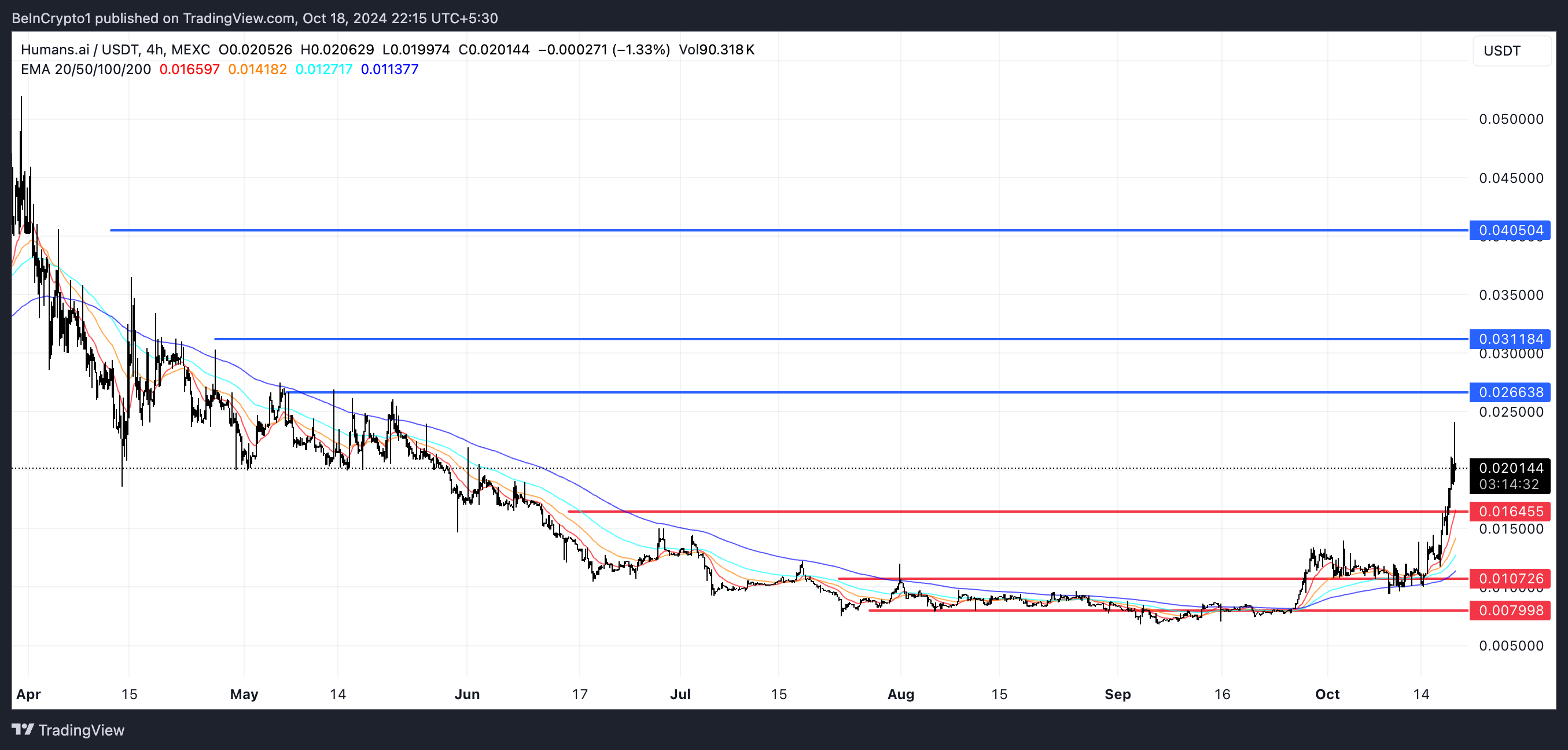

Chart diagnosis means that HEART may maybe maybe continue its upward pattern, as indicated by its EMA (Exponential Keen Average) lines forming a bullish pattern. The subsequent key resistance ranges are at $0.026 and $0.031, and breaking via these may maybe maybe search for HEART upward push additional to $0.040, representing a doable doubling in designate.

Study more: How To Invest in Synthetic Intelligence (AI) Cryptocurrencies?

Nonetheless, its RSI (Relative Energy Indicator) for the time being stands at 73.61, indicating that the asset is drawing approach overbought conditions, that can even neutral consequence in a correction. Within the tournament of a reversal, HEART has established make stronger around $0.016, and if that level doesn’t lend a hand, it may maybe maybe plunge additional to helps at $0.010 and even $0.007, which may maybe maybe indicate a correction of as a lot as 65% from present ranges.

Virtual Protocol (VIRTUAL)

VIRTUAL Protocol (VIRTUAL) has skilled a 76% surge within the past seven days, turning into one amongst the close gainers amongst synthetic intelligence coins. The mission is a decentralized platform that facilitates the enhance and monetization of AI personas for digital worlds, at the side of video games and metaverses.

Chart diagnosis indicates that VIRTUAL may maybe maybe withhold its upward momentum, as its EMA lines for the time being mirror a bullish pattern. The subsequent resistance level to notice is at $0.146, suggesting a that that it’s likely you’ll maybe be imagine 46% upside.

Nonetheless, the present RSI of 64.29 indicators that VIRTUAL is drawing approach overbought territory, that can even neutral limit additional gains or trigger a momentary pullback. In case of a pattern reversal, VIRTUAL has solid make stronger at $0.073, which may maybe maybe signify a doable 27% correction from its present designate.

THEY

And sooner or later, DIA has risen 21.67% staunch via the last week, exhibiting essential strength available within the market. DIA affords inappropriate-chain oracle solutions for the Web3 ecosystem, offering a differ of products and services, at the side of designate feeds for digital resources, custom ground designate feeds for NFTs, and randomness for DeFi and GameFi capabilities.

Study more: How Will Synthetic Intelligence (AI) Remodel Crypto?

Chart diagnosis means that DIA may maybe maybe preserve its upward momentum, as indicated by the bullish alignment of its EMA lines. The subsequent resistance ranges are at $1.18 and $1.25. Nonetheless, the narrowing distance between the EMA lines indicators that bullish momentum may maybe smartly be weakening, and caution is warranted because it’ll also neutral hint at an upcoming consolidation or reversal.

Additionally, the RSI for DIA is for the time being at 59.55, indicating that it’s no longer yet in overbought territory nevertheless may maybe smartly be drawing approach it, suggesting some room for additional enhance. If the pattern turns, DIA has solid make stronger at $0.72 and $0.66, nevertheless a fracture under these may maybe maybe consequence in a additional decline, doubtlessly all of the components down to $0.569, representing a that that it’s likely you’ll maybe be imagine 44% designate correction.

Disclaimer

Essentially primarily based fully on the Belief Challenge guidelines, this designate diagnosis article is for informational purposes easiest and can neutral nonetheless no longer be regarded as monetary or investment advice. BeInCrypto is committed to appropriate, self reliant reporting, nevertheless market conditions are topic to trade without peek. Consistently conduct your maintain be taught and search the advice of with a legit sooner than making any monetary choices. Please expose that our Terms and Stipulations, Privateness Coverageand Disclaimerswere updated.